Financial Industry Solution

One-stop financial industry solution for digital marketing, digital engagement, and digital security for financial industry

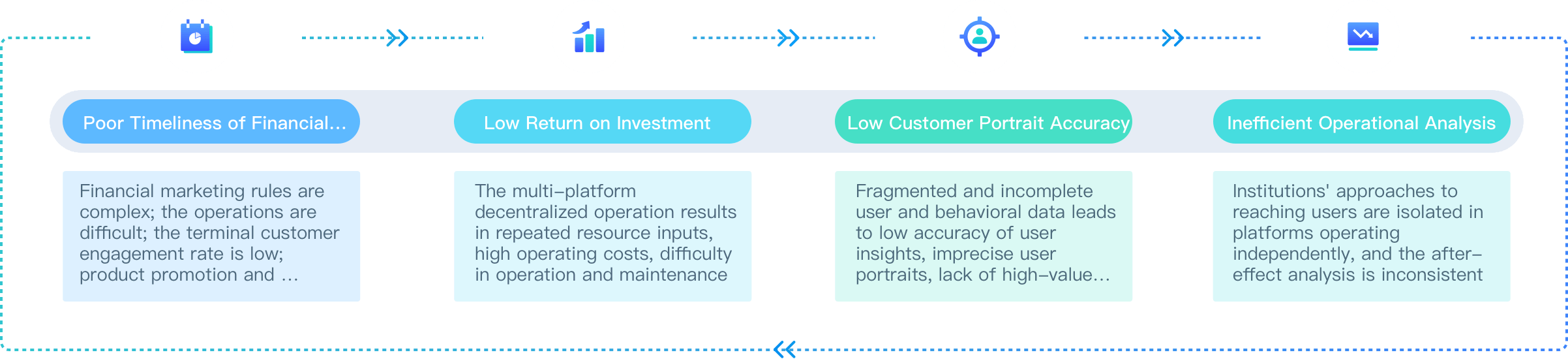

Industry Difficulties & Challenges

- Industry and Challenges

- Solution

- Architecture

- Customer Case

- Partners

- Contact Us

Transaction & Payment—High Cost of Reaching Users

Loan & Insurance—Difficulty in User Risk Control

Banks & Securities—High Requirements for Data Security

Marketing & Operation—Difficulty in Statistical Analysis and Application

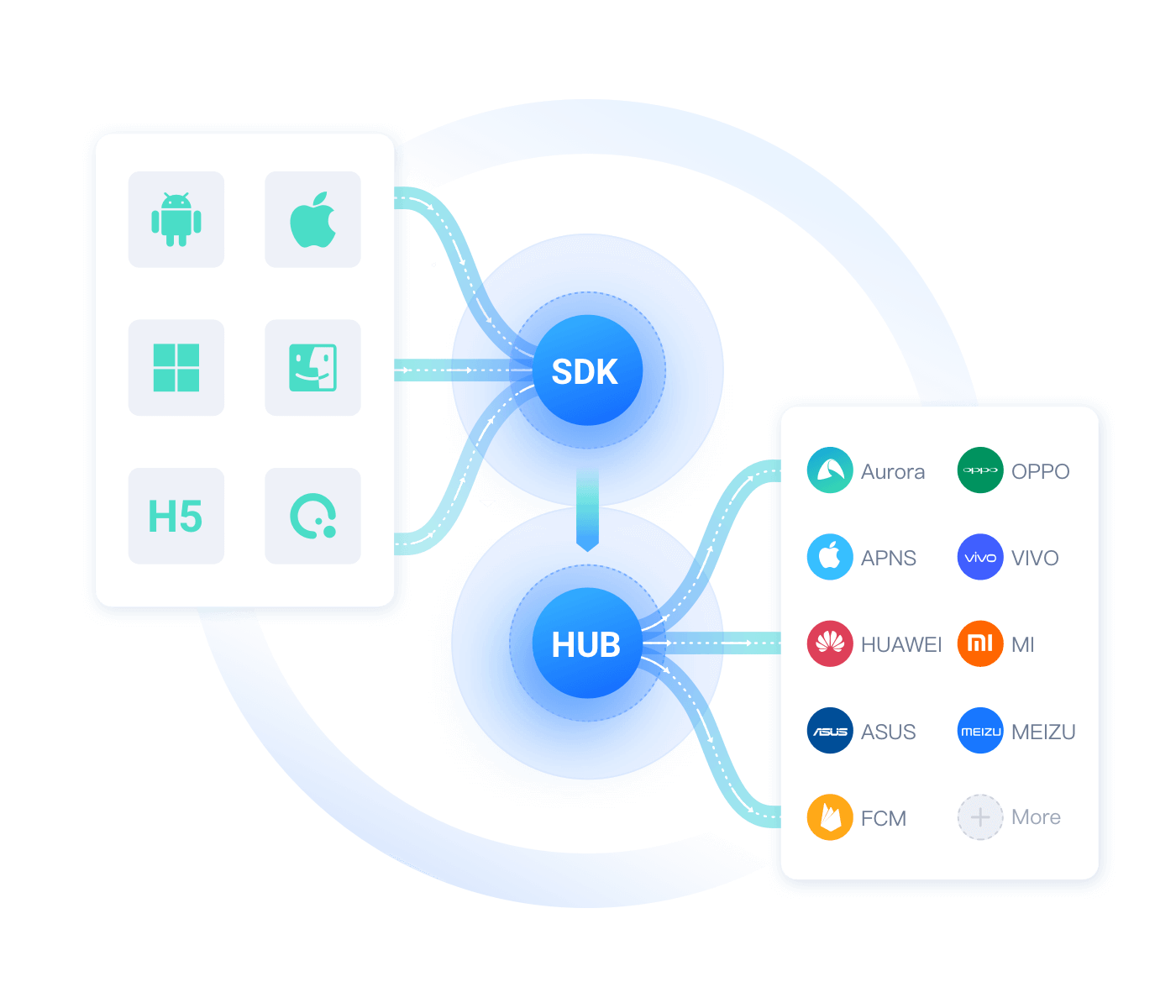

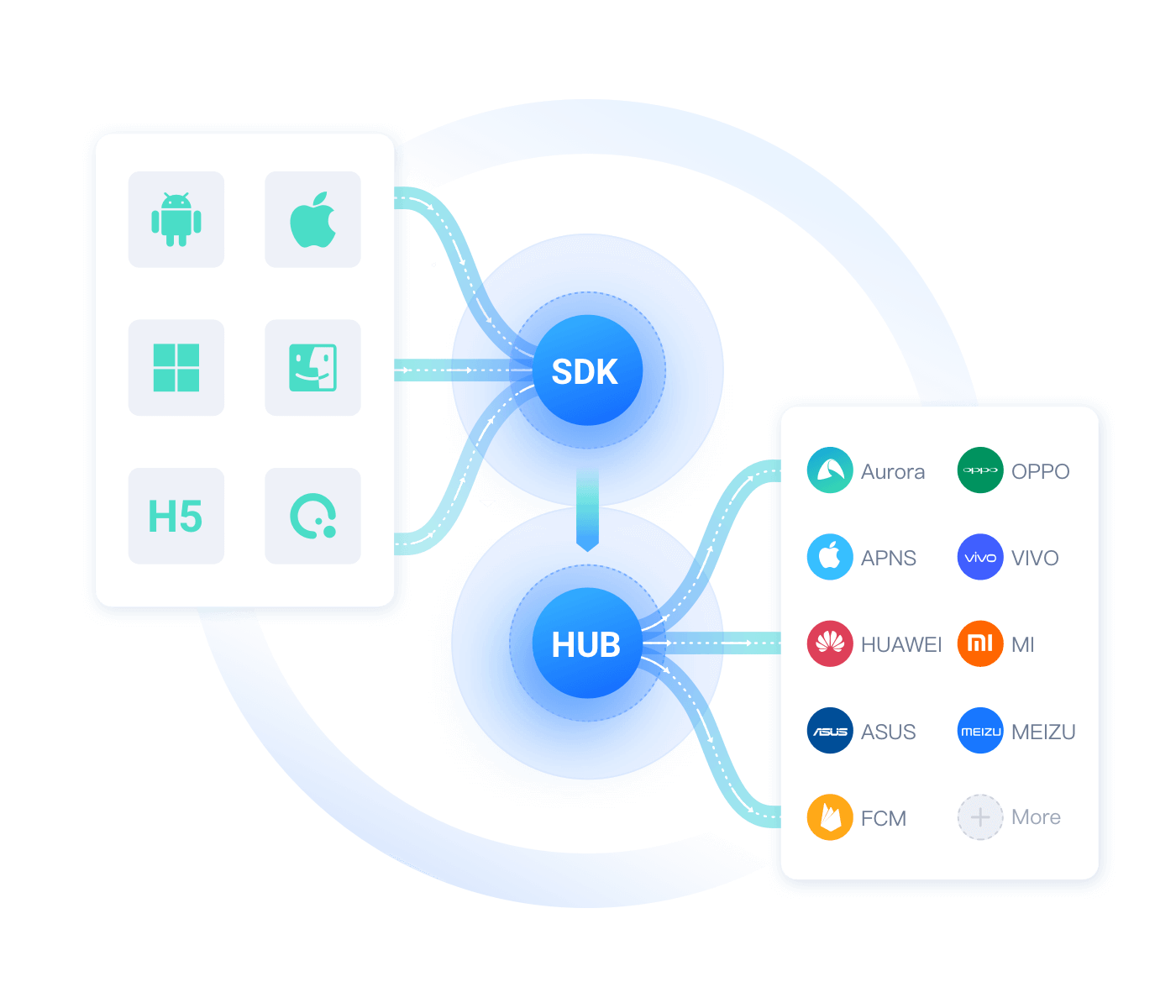

Build Information Links to Connect Users

Apply App Push, mobile phone system, and the push capabilities of third-party platforms in an alliance approach to build a link for financial institutions to engage with users by delivering banking, insurance, securities, and fund-related messages safely and efficiently.

Build Information Links to Connect Users

Apply App Push, mobile phone system, and the push capabilities of third-party platforms in an alliance approach to build a link for financial institutions to engage with users by delivering banking, insurance, securities, and fund-related messages safely and efficiently.

App Push Channel

- The unobstructed App Push channel ensures efficient delivery of push notifications, and mainstream phone makers' channels are integrated to improve the user reach rate and timeliness of APP messaging system

Multi-Platform Messaging Integration

- Mainstream messaging channels can be integrated to deliver messages in varying operation scenarios through different strategies, e.g. App Push + SMS for transaction records, App Push + WeChat Mini Program for promo activities, and DingTalk + WeChat Work for private domain operation

Strategy-based Push Notification

- Multiple channels mutually supplement for re-delivery. Notifications can be sent by broadcast, single point, group, alias, etc., and differentiated, optimal user reach strategies are offered to suit different messaging frequencies and timeliness requirements e.g. transaction records, promo activities, security warning.

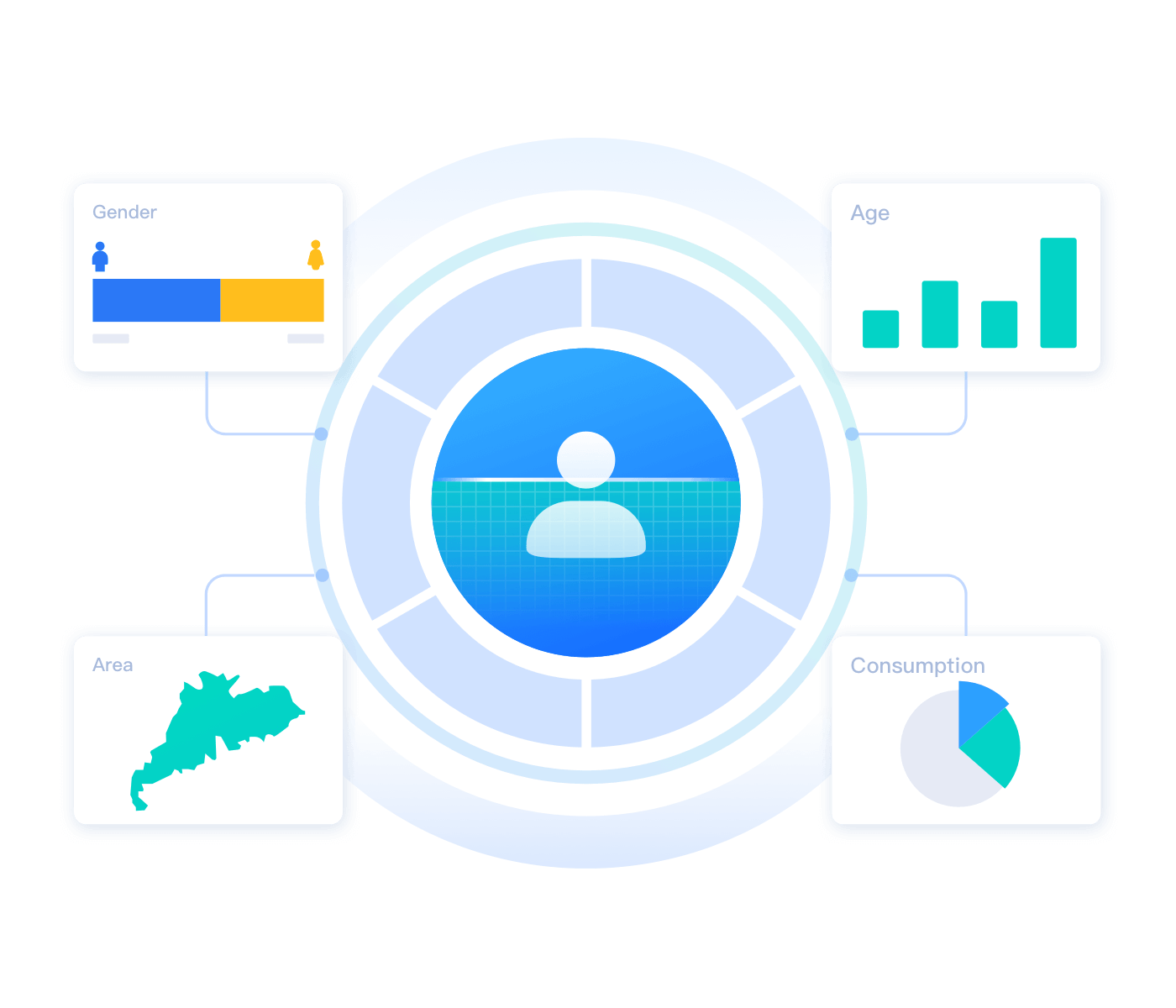

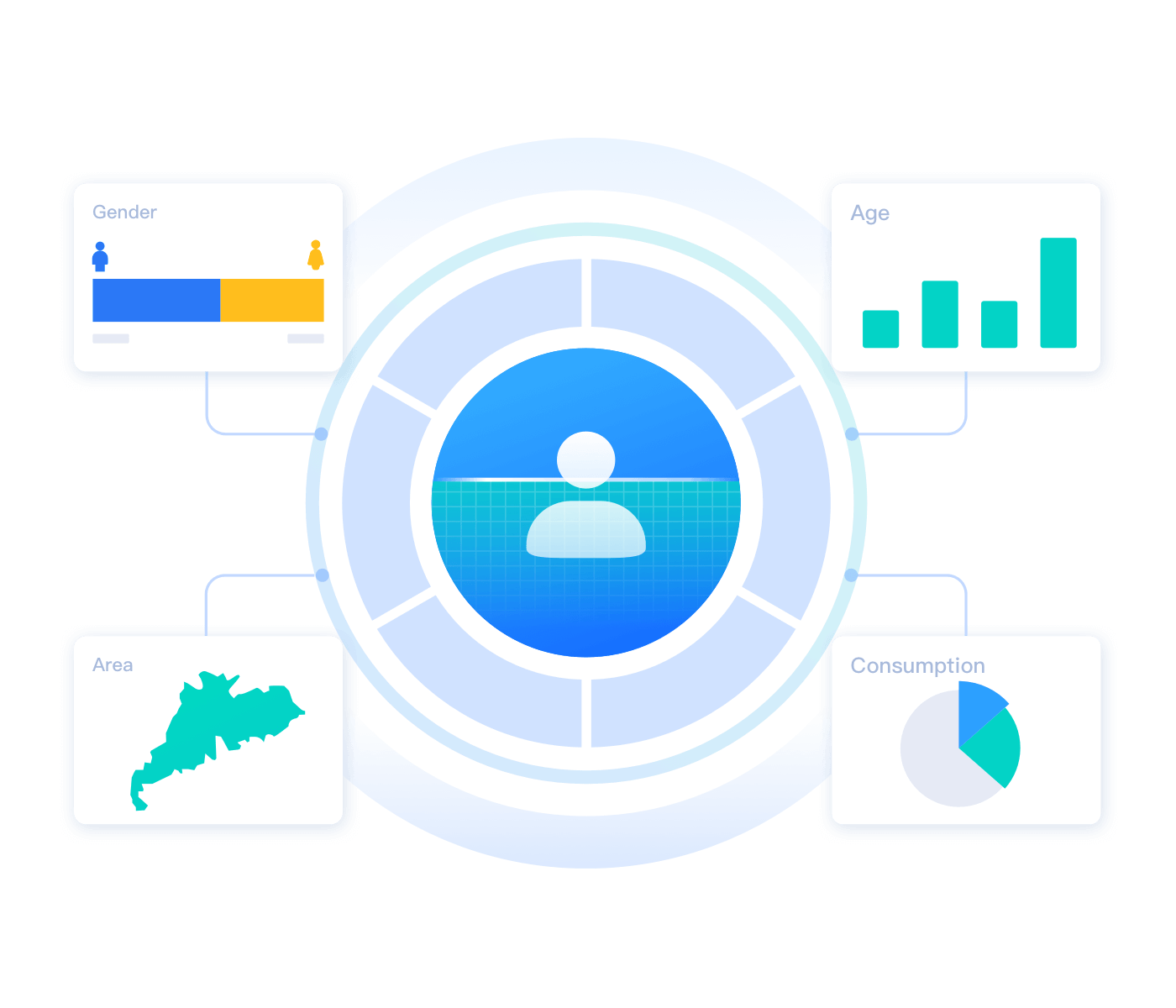

Depict Holographic Portraits of Financial Customers

Depict accurate user portraits based on the metadata of financial institutions and Aurora Mobile’s model, to strengthen the marketing-user correlation, and drive refined marketing with data.

Depict Holographic Portraits of Financial Customers

Depict accurate user portraits based on the metadata of financial institutions and Aurora Mobile’s model, to strengthen the marketing-user correlation, and drive refined marketing with data.

Intelligent Tag

- With the data and experience of the banking and insurance sectors, user attributes are analyzed via AI, and KYC information is improved, to facilitate refined user operations

User Rating

- Joint modeling scoring is carried out to accurately stratify targets, identify user consumption levels, do credit rating, and predict user behaviors

Operations by User Group

- Operations are carried out by user groups to improve target accuracy, enable targeted JOperations, and enhance the value of effective traffic

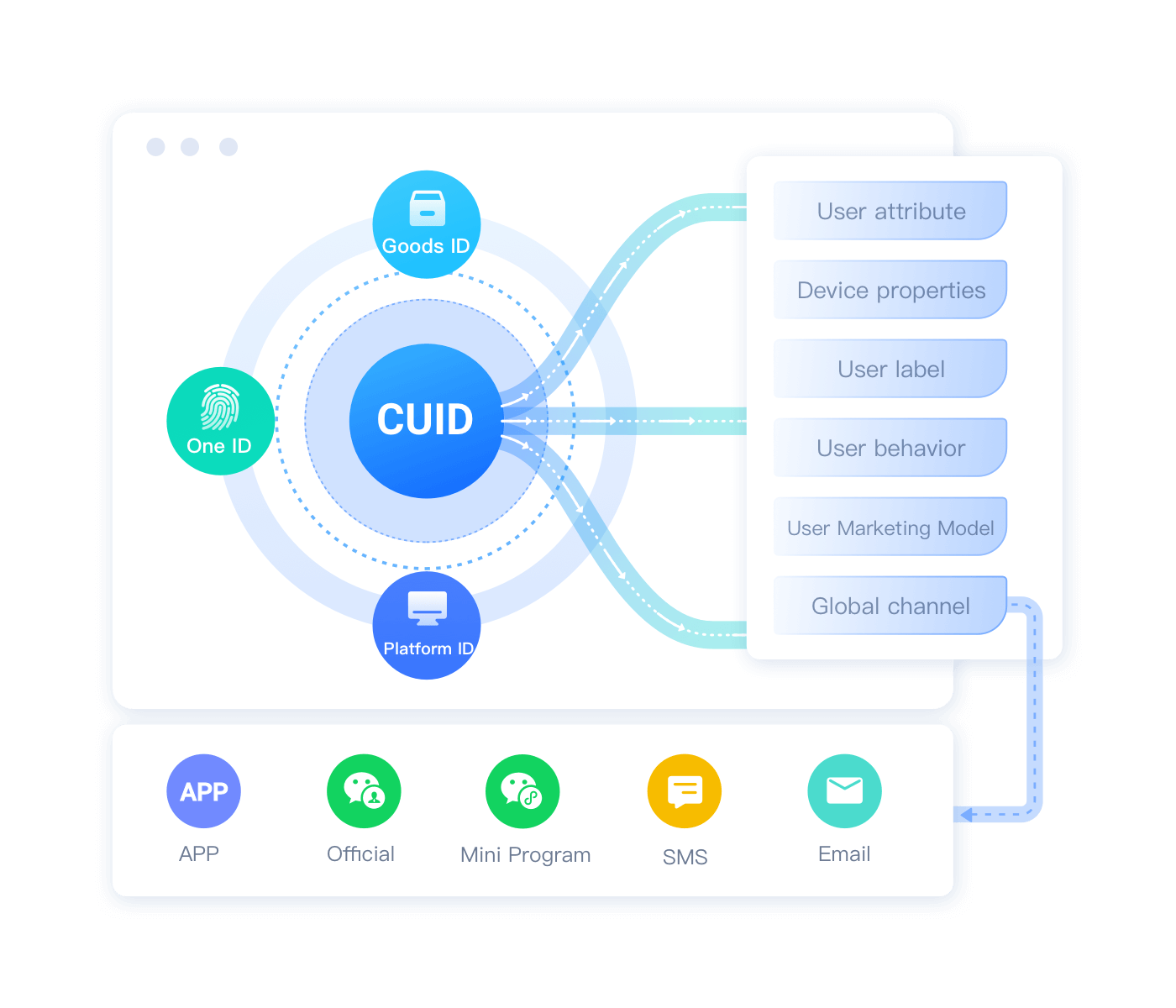

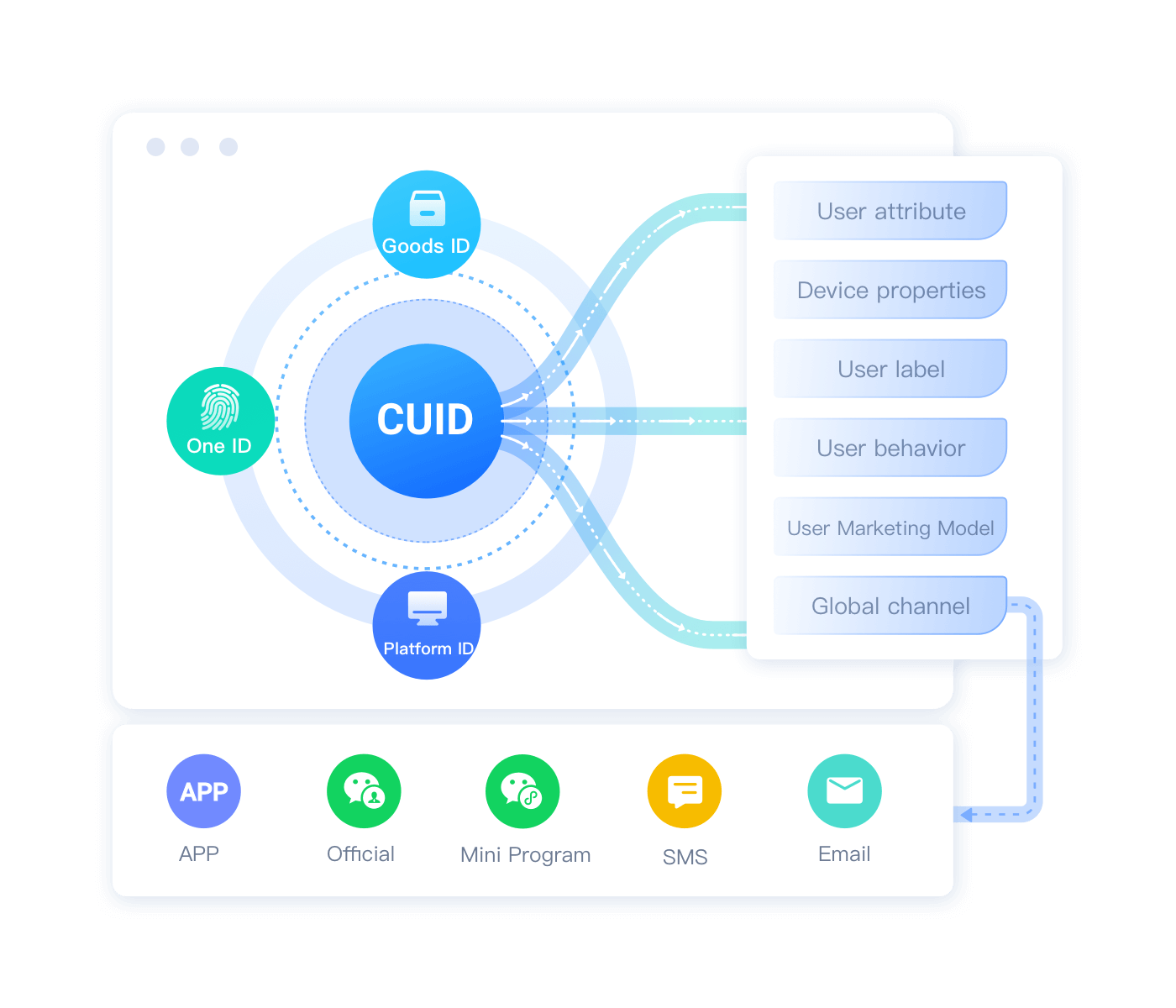

Customer-Centered AI Marketing

User behaviors and lifecycles are identified with the aid of AI perception and big data analysis capabilities, to enable personalized marketing and build an JOperation system, so financial institutions can increase traffic value through customer-centric marketing.

Customer-Centered AI Marketing

User behaviors and lifecycles are identified with the aid of AI perception and big data analysis capabilities, to enable personalized marketing and build an JOperation system, so financial institutions can increase traffic value through customer-centric marketing.

Unified Data Aggregation

- Big data barriers within institutions and third-party users are broken down and financial digital assets and unified data are gathered to build a data mart

360° User Insights

- Based on tags of institutions and Aurora Mobile, holographic user portraits are depicted to accurately identify users' credit ratings, consumption levels, loan willingness, investment preferences, etc.

AI-enabled User Grouping

- User value is predicted with AI to facilitate group-based operations, formulation of operation plans, and recommendation of marketing activities

Intelligent Recommendation

- Based on operation plans, operation resources are intelligently aligned with channels to reach users, to enable personalized marketing and connect the user analysis results with user engagement and advertising

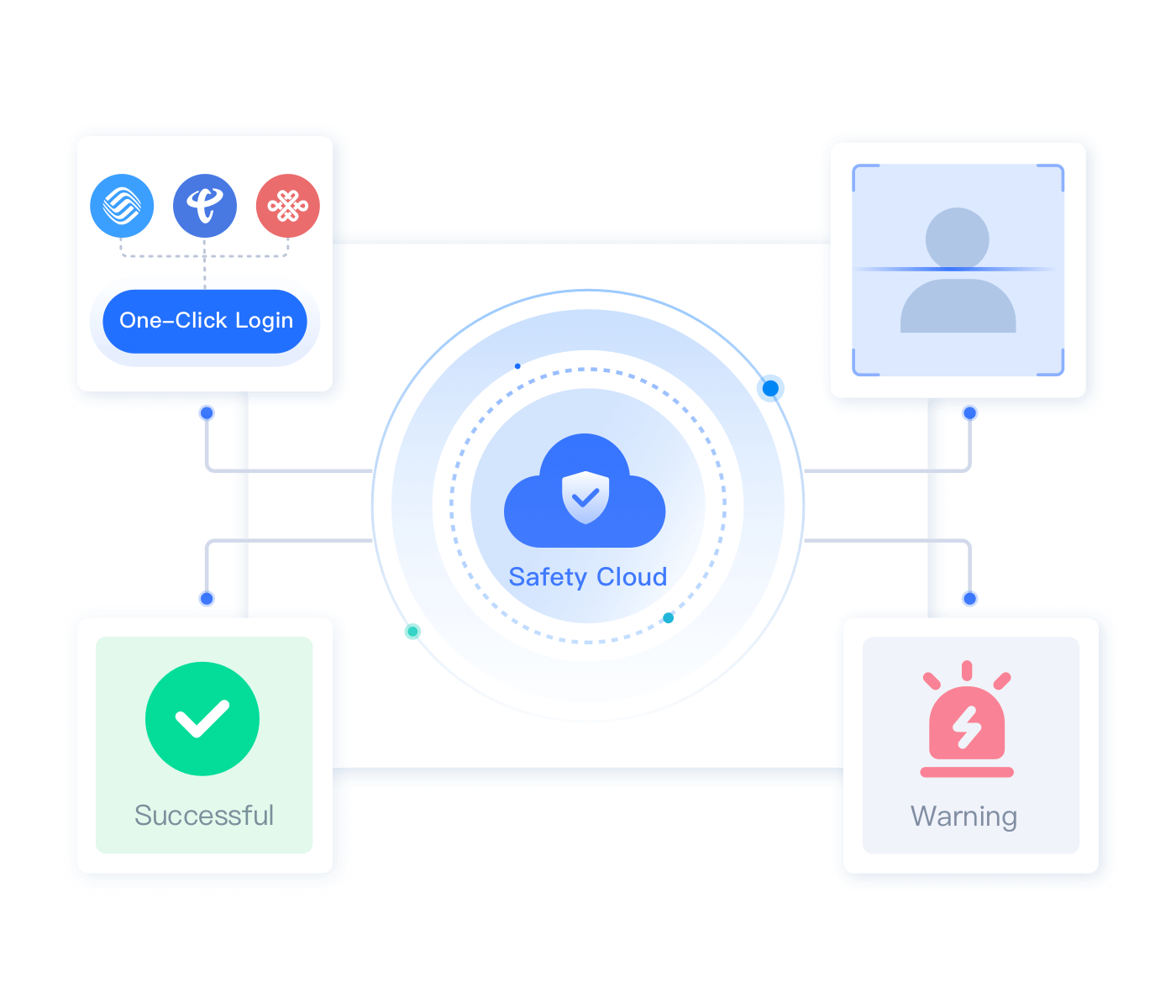

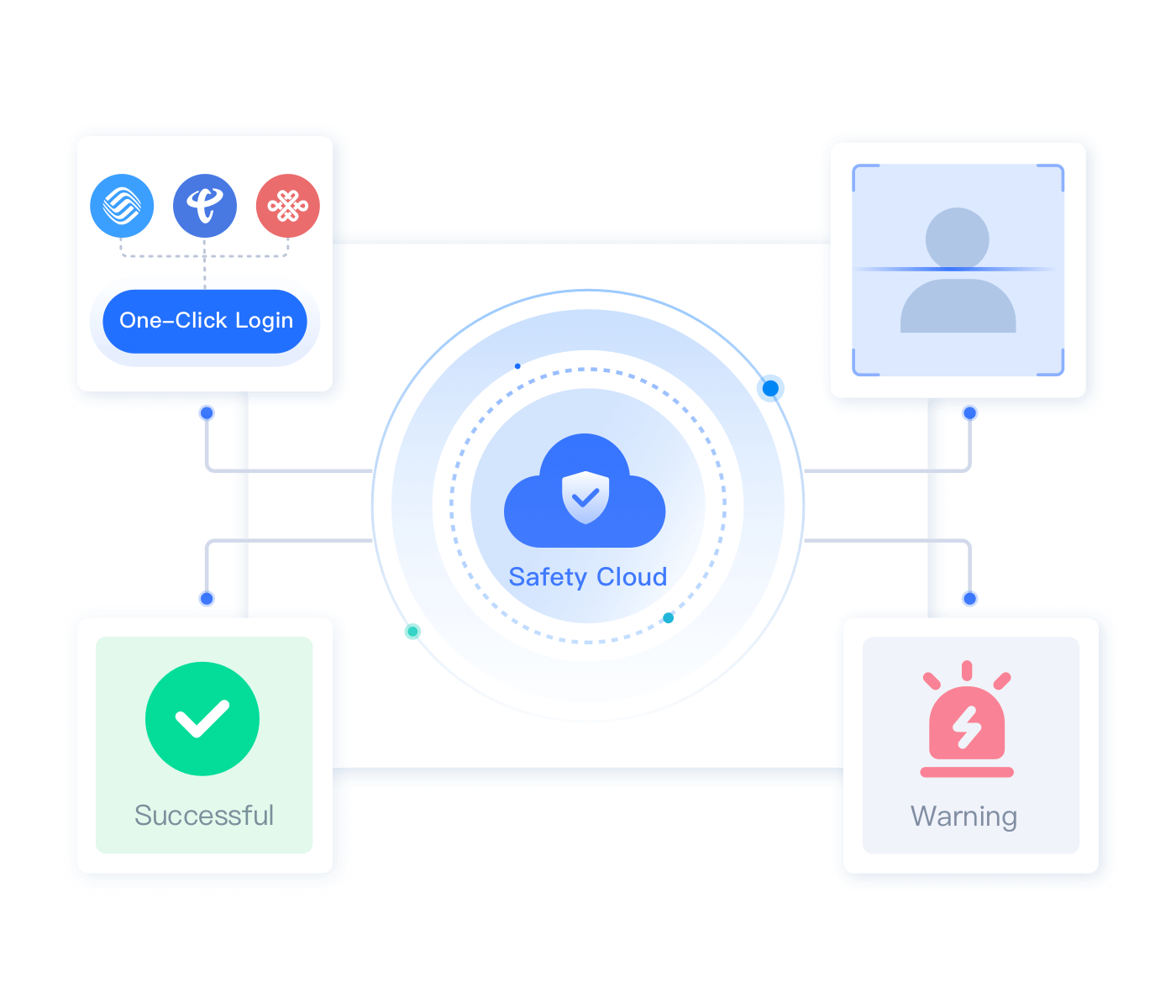

Security CloudProtect Financial Business Security

Security CloudProtect Financial Business Security

One-click Login

- One-click SIM card login reduces the security risk of financial client end login and user loss at the conversion stage, and the risk of verification code leakage

Phone Number Verification

- Sensor-free user identity verification optimizes user experience and improves verification efficiency

Behavior Detection

- Risky user behaviors in multiple scenarios such as login and transaction are detected intelligently, and early warnings of anomalies are given to avoid losses to users and institutions

Black Industries Prevention

- Institutional data and third-party big data are applied together to enable user security rating, and send out early warnings in anti-fraud, anti-money laundering, anti-insurance fraud and other scenarios to prevent losses

Financial Solution Architecture

Customer Case

CEB Credit Card Yang Guang Hui Sheng Huo (Yang Guang App)

With the user-defined encryption standards in line with the SM2 algorithm of Chinese national standards, JPush can provide users with financial-class protection, greatly reducing the risk of information hijacking. Besides, based on our precise user portrait function and the tracking and after-effect analysis on push notifications, we help Yang Guang App constantly improve its push policies for refined and individualized intelligent push, thus avoiding disturbance to users caused by useless information and raising the click-through rate and user conversion rate.

Partners

Contact Us

Please leave us your contact information. Our business managers and technical experts will get back to you as soon as possible!

can't be empty

Please enter the correct 11 digit mobile phone number

can't be empty

can't be empty

- JPush(Serve Chinese Mainland)

- JSMS(Serve Chinese Mainland)

- JUMS(Serve Chinese Mainland)

- Adpub

- JOperation

- JAnalytics

- JPortrait

- FinTech

- iAudience

- Risk Marketing Score

- JVerification

- JMLink

- EngageLab-AppPush(Serving the World)

- EngageLab-WebPush(Serving the World)

- SendCloud-Email(Serve Chinese Mainland)

- EngageLab-Email(Serving the World)

- EngageLab-SMS(Serving the World)

can't be empty

Submit