- Population characteristics

- Applied behavior characteristics

- Device characteristics

- Financial characteristics

- Social network features

Have You Ever Encountered These Challenges?

Low User Information Coverage

Ineffective Risk Control Model

Lack of Customer Risk Assessment

Unstable Data and Lack of Model Diversity

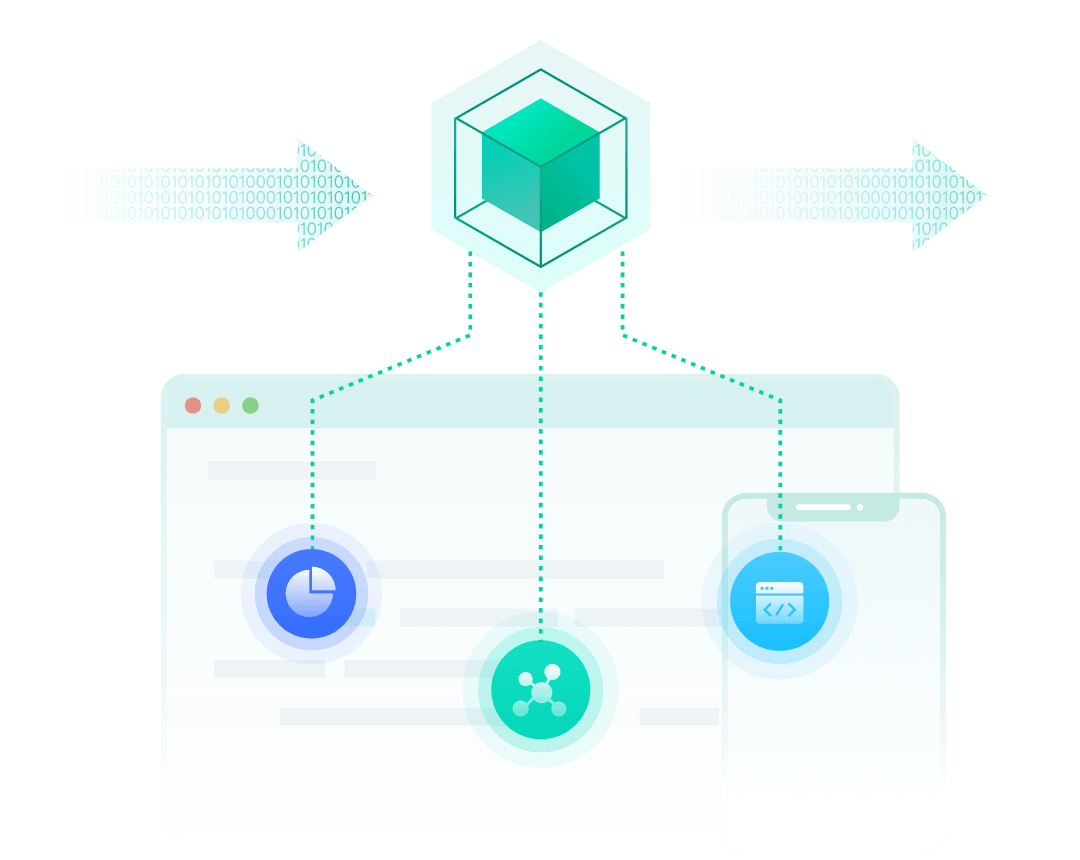

FinTech Product Functions

- Customized factor development

- Local sandbox environment

- On-site modeling support

Why Should You Choose FinTech?

Wide Data Coverage

Data Compliance and Fast Update

Wide Indicator Coverage

More Flexible Ways to Access Data

Application Scenario

Pre-loan

User acquisition

Portraits

Anti-fraud

Access to credit granting

User grouping

risk factors、iAudience tags

Fraud grading

Negative behaviors、Blacklist、risk factors

Loan-In

Credit limit increase

Risk control grading

risk factors

Post-loan

Post-loan management

Overdue collection

Abnormal behavior alarms

Abnormal behaviors、risk factors

Solvency assessment

risk factors、iAudience tags

Contact Us

Please leave us your contact information. Our business managers and technical experts will get back to you as soon as possible!

- JPush(Serve Chinese Mainland)

- JSMS(Serve Chinese Mainland)

- JUMS(Serve Chinese Mainland)

- Adpub

- JOperation

- JAnalytics

- JPortrait

- FinTech

- iAudience

- Risk Marketing Score

- JVerification

- JMLink

- EngageLab-AppPush(Serving the World)

- EngageLab-WebPush(Serving the World)

- SendCloud-Email(Serve Chinese Mainland)

- EngageLab-Email(Serving the World)

- EngageLab-SMS(Serving the World)

Submit